Did you know that businesses transfer over $150 trillion globally each year? With the increasing need for international money transfers, it is crucial for companies to find a reliable and cost-effective solution.

Wise provides just that with its payment processing software, allowing businesses to transfer money in multiple currencies to users across different countries. In this article, we will explore the pros and cons of using Wise for international money transfers, based on customer experiences and reviews.

Wise Features and Pricing

In this section, we will explore the various features and pricing options offered by Wise. With Wise, users can enjoy a range of functionalities that make international money transfers seamless and convenient.

Send and Receive Funds in Multiple Currencies

Wise allows users to effortlessly send and receive funds in multiple currencies, eliminating the need for complicated currency conversions. Whether you’re a business owner, freelancer, or individual, Wise enables you to easily navigate global transactions.

Manage Finances through a Unified Portal

One of the standout features of Wise is its unified portal, which enables users to manage their finances efficiently. With intuitive navigation and seamless integration, you can monitor your transactions, track payments, and keep your financial records organized in one place.

Accept Payments via PayPal, Payoneer, and Bank Accounts

Wise offers flexible payment options, allowing you to accept funds through popular platforms such as PayPal and Payoneer. Additionally, you can directly link your bank account to Wise, providing a hassle-free method for receiving payments.

Free Version and Usage-Based Fee Structure

Wise caters to users with different needs by offering a free version and a usage-based fee structure. The free version allows you to explore Wise’s basic features, while the usage-based fee structure ensures that you only pay for the services you require. Keep in mind that the availability of the free trial and specific pricing details may vary. To get accurate and up-to-date information, it is recommended to contact Wise directly.

Customers who have used Wise have lauded its array of useful features. The platform provides competitive exchange rates, ensuring that you get the most value out of your international transfers. With an easy-to-use interface, you can navigate Wise’s features seamlessly, even if you’re new to the platform. Additionally, Wise boasts quick transfer times, allowing you to send and receive funds promptly.

| Pros of Wise | Cons of Wise |

|---|---|

| Competitive exchange rates | Difficulties in account opening |

| User-friendly interface | Limited payment options |

| Quick transfer times | – |

Conclusion

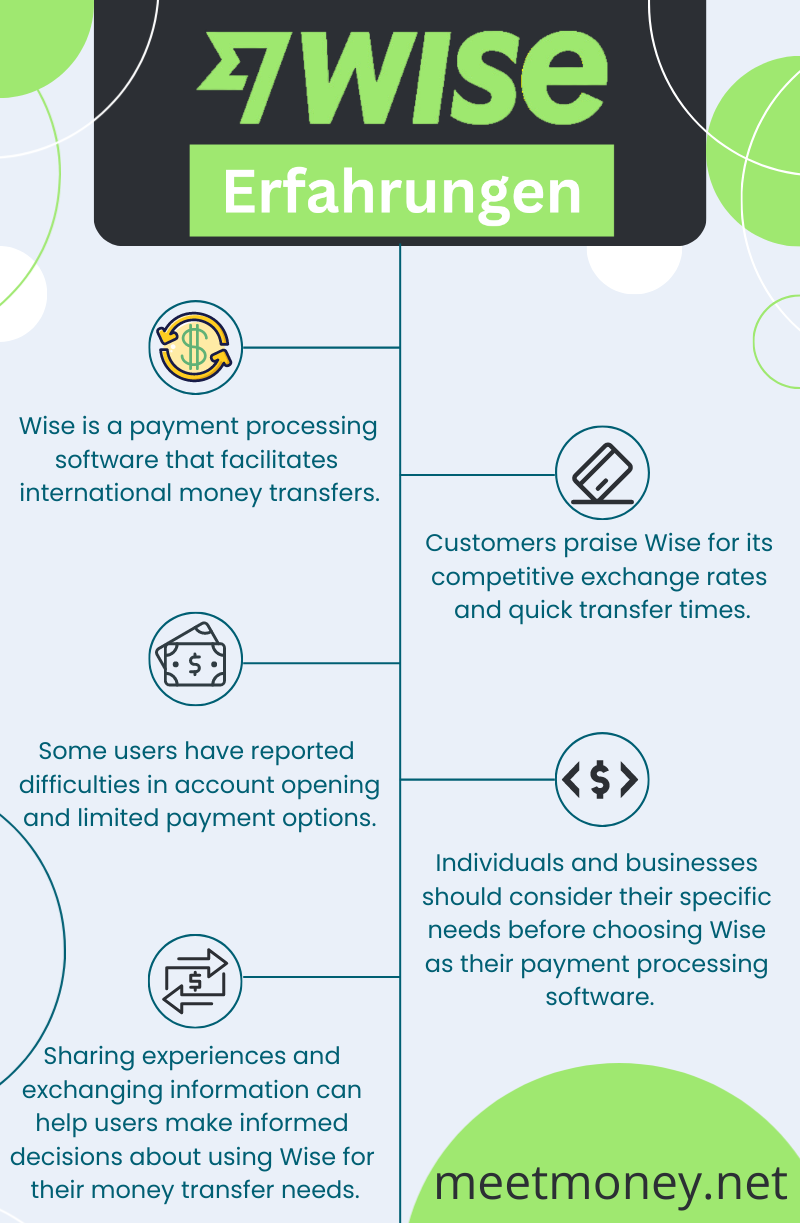

Wise Erfahrungen provide valuable insights into the pros and cons of using Wise for international money transfers. The platform offers competitive exchange rates, ensuring that users get the most value for their money. With quick transfers, individuals and businesses can conveniently send and receive funds with ease. Additionally, the user-friendly interface of Wise simplifies the process of managing finances across multiple currencies.

However, it’s important to acknowledge that some users have encountered challenges when it comes to account opening and limited payment options. These factors should be taken into consideration before deciding if Wise is the right payment processing software for your specific needs.

Exchanging experiences and sharing information with others can be a valuable resource in making an informed decision about using Wise for your money transfer requirements. Discussing the various pros and cons can help individuals and businesses weigh the advantages and disadvantages, ultimately leading to a well-informed choice about utilizing Wise.

FAQ

What is Wise?

Wise is a payment processing software that allows businesses to transfer money in multiple currencies to users across international countries. It caters to the specific needs of various users, including enterprises, merchants, freelancers, and financial institutions.

What services does Wise offer?

Wise enables users to send and receive funds for domestic remittances, online shopping, and invoice payments. It offers competitive exchange rates, quick transfers, and a user-friendly interface.

What are the advantages of using Wise for international money transfers?

Wise provides cost-effective solutions for international money transfers. It offers competitive exchange rates, quick transfers, and a user-friendly interface.

Are there any disadvantages to using Wise?

Some users have reported difficulties in account opening and limited payment options while using Wise.

What features does Wise offer and how much does it cost?

Wise offers various features such as sending and receiving funds in multiple currencies, managing finances through a unified portal, and accepting payments via PayPal, Payoneer, and bank accounts. Wise provides a free version and a usage-based fee structure for its services. However, the availability of the free trial and specific pricing details may vary, and users are advised to contact Wise directly for more information.